Survey: Consumers want brands to invest in women’s sports

Survey: Consumers want brands to invest in women’s sports

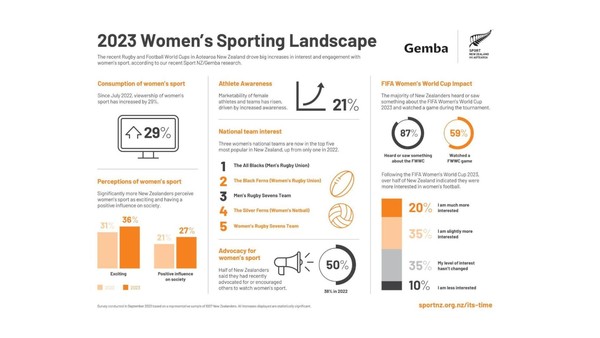

The data points on women’s sports — from attendance records, ticket and merchandise sales and viewership numbers — have all pointed in the same direction: Fans and consumers want more.

A new survey shows fans are saying they want brands to support women’s sports more, too.

Aggregate Sports found 77% believe brands should sponsor women’s sports, 74% think they should do that equally for men and women and 71% believe women’s sports will increase in popularity in the coming years.

Partnering with technology platform Suzy on the survey, Aggregate Sports polled 1,000 casual or avid sports fans ages 18-65 in late September. Their findings echo those of other recent reports from the Sports Innovation Lab and The Collective, the women-focused practice at Wasserman.

Playing the percentages

Of 1,000 casual or avid sports fans, age 18-65, polled in late September:

77%: Think brands should sponsor women’s sports

74%: Think brands should support men’s and women’s sports equally

62%: Feel better about brands that sponsor women’s sports

Source: Aggregate Sports

“If you’re looking at data that’s talking about consumer behavior, and you see numbers like 77%, 74%, I think that’s a pretty telling data point on the fact that consumers of their products want to see investment in women’s sports,” said Danette Leighton, Women’s Sports Foundation CEO. “It’s exciting to see numbers that are proving that consumers want to see investment by brands in women’s sports.”

Aggregate Sports — which works in areas including property sales, consulting and media rights — conducted the survey to test what it had observed anecdotally: that increased interest in women’s sports, especially in basketball and soccer, wasn’t translating to support for their Olympic clients. The agency counts USA Gymnastics, U.S. Figure Skating and U.S. Ski & Snowboard among the nine national governing bodies it works with, but does not represent athletes.

“There’s a lot of catching up to do, and women’s sports deserve it,” said Rem de Rohan, co-founder and chief revenue officer of Aggregate Sports, “and it’s also a wonderful place for brands to be.”

Consumers said as much. Among the survey’s other results:

• 62% feel better about brands that sponsor women’s sports.

• 58% said in separate questions that brands should sponsor women’s Olympic sports more than women’s pro leagues and that women’s Olympic sports are more prestigious than pro sports.

• More respondents said they were likely to be a fan of an Olympic sport (39%) than of women’s pro leagues (17%), while 44% they would be an equal fan of both.

“We are not the first ones at the table to say, ‘Support women’s sports.’ This is not a big epiphany,” de Rohan said. “But there’s layers to that. There are a lot of leagues and teams that kind of suck up the space of women’s sports, and there’s a handful that are just left out, but they should be included too.”

Aggregate Sports’ data is in line with other data released just in the last few weeks.

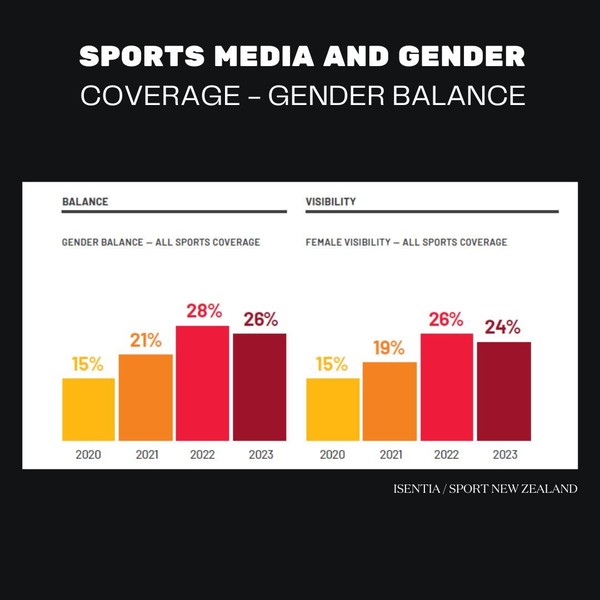

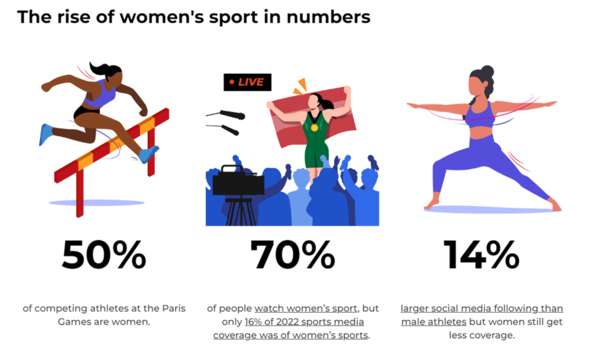

Last month, Wasserman’s research found that media coverage of women’s sports has increased to 15%, thanks to the growth of digital streaming and social media, after long being stuck around 4%.

The Collective looked at data from 2018-22 and projected that if growth continues at the same rate, coverage of women’s sports would reach 20% by 2025.

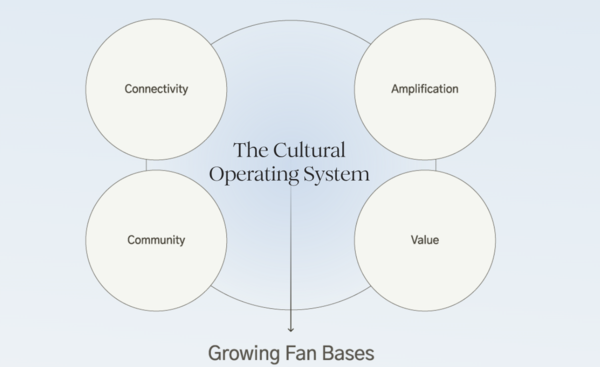

Also last month, a Sports Innovation Lab report offered a blueprint for investing in women’s sports centered on the return on investment they bring. It built on the company’s previous findings that showed brands that sponsored women’s sports received an immediate increase in engagement and higher levels of affinity than for the general sports fan.

That 2021 study showed a 2,700% year-over-year increase for Visa after announcing its sponsorship of the U.S. women’s national soccer team, for example, and 1,075% increase for Budweiser after announcing an NWSL sponsorship.

“When the brands show up, they actually reward brands with their dollars,” said Gina Waldhorn, CMO at Sports Innovation Lab. “Pay attention. They’re asking for it. And even if that doesn’t help you secure the budgets, just look at the ROI at the brands that sponsor.”

Add that to the anecdotal data points. Nebraska volleyball and Iowa women’s basketball played games in football stadia, setting records for attendance at a women’s sporting event (92,003) and women’s basketball game (55,646), respectively.

“These are all stats that have been data points that men’s sports have talked about for years, and the expectation is that women didn’t have those types of numbers,” Leighton said. “And that’s just false.”

Facing scrutiny and consumer demand, Nike reversed course and produced replica goalkeeper kits after the Women’s World Cup. Despite the fragmented nature of distribution and getting less desirable broadcast spots, viewership of women’s sports has continued to grow at what Nielsen called a “meteoric rise.”

“It is certainly the right thing to invest in half the population, to give women athletes every opportunity that men athletes have been afforded for years and years,” said Caroline Fitzgerald, founder of GOALS and host of The Business Case for Women’s Sports podcast. “It’s not only the right thing to do. The really special value proposition for women’s sports is that what is right lives alongside what is profitable.”

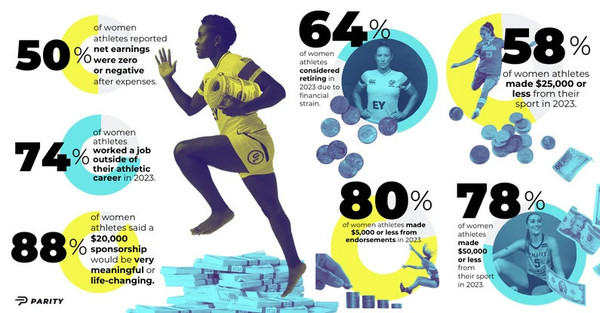

Sports Innovation Lab surveyed brands across industries, including Fortune 500 companies, and found that on average, they were spending 9% of their sports media investment on women’s sports. While 83% of those companies planned to increase that spend in 2024, more than two-thirds of those expected to increase it by 10% or less.

“They’re not big enough steps to get us where we want to go fast enough,” Waldhorn said.

Aggregate Sports would like to see more spending in Olympic sports, and the survey shows that consumer demand. The survey asked respondents to pair top female athletes with their sport, and the top five were all Olympians — gymnast Simone Biles, swimmer Katie Ledecky, snowboarder Chloe Kim, skier Mikaela Shiffrin and gymnast Sunisa Lee.

Despite that, fewer than 50% could identify any of them. Biles, regarded as the greatest gymnast ever with 37 world or Olympic medals, led the list at 48% recognition.

To Aggregate Sports, that backs what mounting data has shown: there’s ample opportunity to invest in women’s sports.

“It’s a great reminder that there’s opportunity outside of maybe the traditional stick-and-ball league to invest in women’s sports in a place where consumers actually do value it,” said Ramsey Baker, senior vice president at Aggregate Sports. “The more information that is available for brands who are considering investing in women’s sports, the better job they will do spending their money in places where it’s needed and where it can be the most impactful.”

Survey: Consumers want brands to invest in women’s sports (sportsbusinessjournal.com)