The Halo of Value Creation Opportunities Around Women’s Sports

Simply put, the growing popularity of women's sports worldwide is one of the most exciting developments for those who view sports as a distinct asset class. It's a sub-sector I like to say "has the wind at its back."

Over the past several years – nearly a decade for Bruin Capital – investors have increasingly moved money into male sports teams, leagues and the surrounding ecosystem to capitalize on growth opportunities born from technological disruption. It's now a smart play to get behind storied entities with decades of brand equity and historically consistent growth trends – especially when that growth is poised to accelerate through unprecedented global accessibility and innovation.

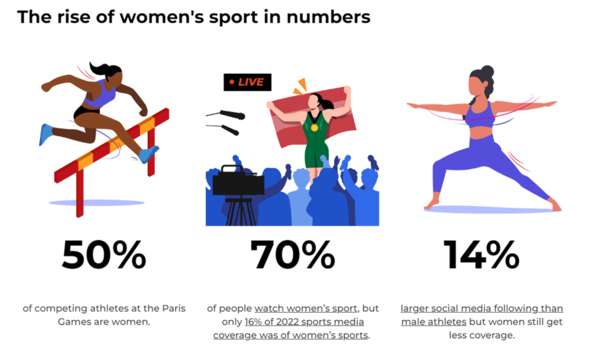

Women's sports haven't previously delivered the same fundamentals and growth as men's sports. However, recent attention-grabbing performances across the most meaningful metrics (audience size, engagement, revenue generation, etc.) represent a movement that shows no signs of slowing down.

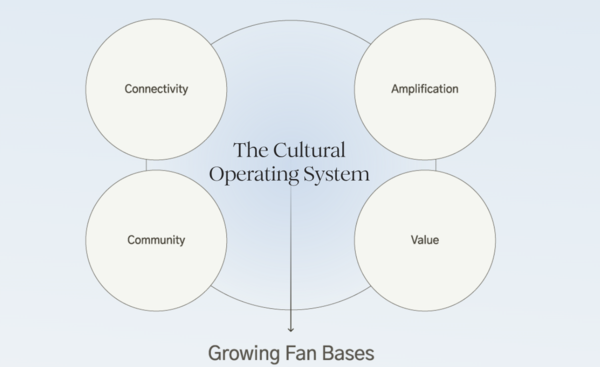

What’s behind this is a clear shift in our social mores and the power of community fostered by social and digital media. Of course, men’s sports are also riding the tech-born wave to attract more private investment than ever. However, those deeply entrenched business models are being re-engineered to accommodate new innovations. Conversely, women’s sports are in the formative stages, with more of a “get in at the ground floor” allure. That's why we anticipate more money, more opportunities and a high frequency of trades in and around women's sports for the foreseeable future.

Fundamental Momentum

The numbers we’re seeing seemed unimaginable even just a few years ago: last month’s UEFA Women’s Champions League final logged a 56% increase in year-over-year viewership, Caitlin Clark’s first three nationally televised appearances were the most watched WNBA games since 2002, and the inaugural Professional Women’s Hockey League season has garnered strong ratings (average audience of 1.1 million). Looking ahead, the Olympics – historically a transformative platform for women’s sports – promises to generate even more interest, and notably, there’s gender parity between male and female athletes for the first time.

Deloitte estimates that women’s sports will generate nearly $1.3 billion in revenue in 2024, compared with $692 million in 2022. Teams, leagues, and federations will be the main beneficiaries, buoyed by rising rights fees, more sponsorship dollars, and increased live attendance. Case in point – for the first time ever, three WNBA teams have sold out of season tickets (Las Vegas Aces, Dallas Wings, and Atlanta Dream).

As a result, teams and leagues are most likely to attract investor interest. However, there is a broader ecosystem of compelling value-creation opportunities for entrepreneurs and investors seeking whitespace and sustainable upside.

The Real Estate Opportunity: Sports Venues and Academies

For municipalities and private investors alike, funding the development of venues and facilities for women’s sports represents a hybrid real estate and community development strategy. NWSL Commissioner Jessica Berman has said that two-thirds of the league’s clubs are looking at significant renovations or upgrades to their training facilities, and several more are studying new stadium options. Increasingly, these facilities – including Seattle Storm’s new $60 million basketball facility and Kansas City Current’s 20,000 capacity, $117 million stadium (the first built specifically for a women's sports team in the U.S.) – are being funded by private investors.

Opportunities still exist for public-private partnerships, too. For example, Boston is in talks to co-fund the redevelopment of Franklin Park’s White Stadium in collaboration with Boston Unity Soccer Partners, with plans for the stadium to house a new professional women’s soccer team, among other uses.

Projects like these give franchises a greater foothold in their communities, foster new ways to attract/activate sponsors in the short term, and create spaces that can be monetized by hosting non-sports events out of season. It's not only a boon to the businesses; the cities benefit with greater tax revenue, jobs, and local events.

The Content Opportunity: Media + Storytelling

Investments in character development and showcasing the personalities behind the athletic talent are essential to generating long-term sustainable interest in leagues outside of the Big 4 or top-tier European soccer. Documentaries, reality shows, and other forms of storytelling have been proven to drive fandom in up-and-coming sports. Formula 1’s growth, especially in the U.S., was rapidly accelerated by Drive to Survive, a creation of Bruin portfolio company Box To Box Films. One of Box to Box’s next projects is “The Offseason,” an unscripted series that follows 11 top NWSL players living and training together in Miami.

For these reasons, emerging content production companies and media partnerships specializing in women’s sports are compelling growth areas for investors and sponsors alike. A good example is The GIST, which epitomizes how the sports journalism landscape is evolving to meet the needs of today’s fans. This media brand provides equal coverage of women's and men's sports. It started in 2017 as a newsletter with 500 subscribers. Five years later, it had 500,000 subscribers across three newsletters. With growth like that, it’s no surprise the organization has already received equity and structured debt capital from various private equity firms, venture capital firms, and business development banks.

Once content begins drawing eyeballs, it naturally leads to extensions. Consider TOGETHXR, a media and commerce venture started by four of the world's greatest female athletes – Alex Morgan, Chloe Kim, Simone Manuel, and Sue Bird. It spans video, podcast, photo production projects, and apparel/fashion products intended to highlight women's voices in sports.

The Hospitality Opportunity: Fan Engagement

Heightened interest in women’s sports is an important milestone but laying down robust fan experience ‘infrastructure’ ensures this interest is a) maintained over time and b) less dependent on fluctuating star power among active competitors.

In the case of women’s sports, there’s a clear hunger among fans to come together. A recent PwC survey found that 33% of women’s sports fans watch to connect with others. Nothing illustrates this better than the growth of The Sports Bra – a bar committed to exclusively broadcasting women’s sports.

Having opened in 2022, the business generated $1 million in revenue within its first eight months, more than three times the average annual revenue generated by bars in the U.S. ($330,000, per BinWise). With new funding from Alexis Ohanian’s 776 Foundation, it’s now set to expand from a single location in Portland, OR, to a national franchise, highlighting how women’s sports can distinguish and catalyze enterprises across other industries. Ohanian has his hands in several women’s sports ventures. He is also a lead investor in Angel City F.C. and is financing the unscripted NWSL series mentioned earlier.

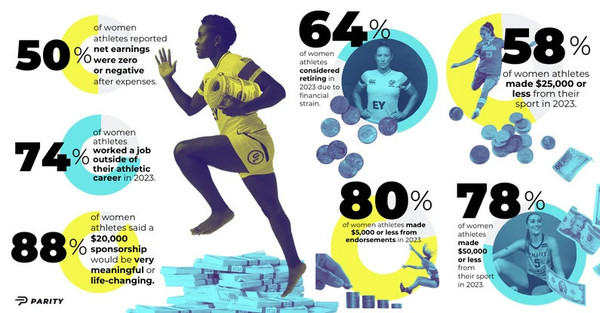

On the virtual side, Parity is an emerging platform offering brands the opportunity to partner with professional women athletes across all sports for campaigns, appearances, and more. Appreciating female athletes and competitions through broadcast and social media is one thing. Brands can use services like these to go a step further by creating in-person activations and 1:1 interactions between their consumers and established/rising women’s sports stars.

Traditional sports hospitality and marketing companies like SPORTFIVE and On Location also stand to benefit from growing interest in women’s sports live events. As established entities with an existing customer base across sports, they can apply their best practices to an even wider ‘inventory’ of opportunities.

Looking Ahead

The opportunity set in women’s sports is so much greater than on-field/court/ice content. We have seen this play out in men’s professional sports, and now – for earlier-stage investors and experimental-minded brands especially – the same prospects for monetization exist on the female side of a thriving industry.

As questions linger about whether recent growth in team revenues and valuations can maintain their trajectory, prudent investors should explore a diversified approach across media, real estate, and hospitality as they look to take part in the upside this sector offers.